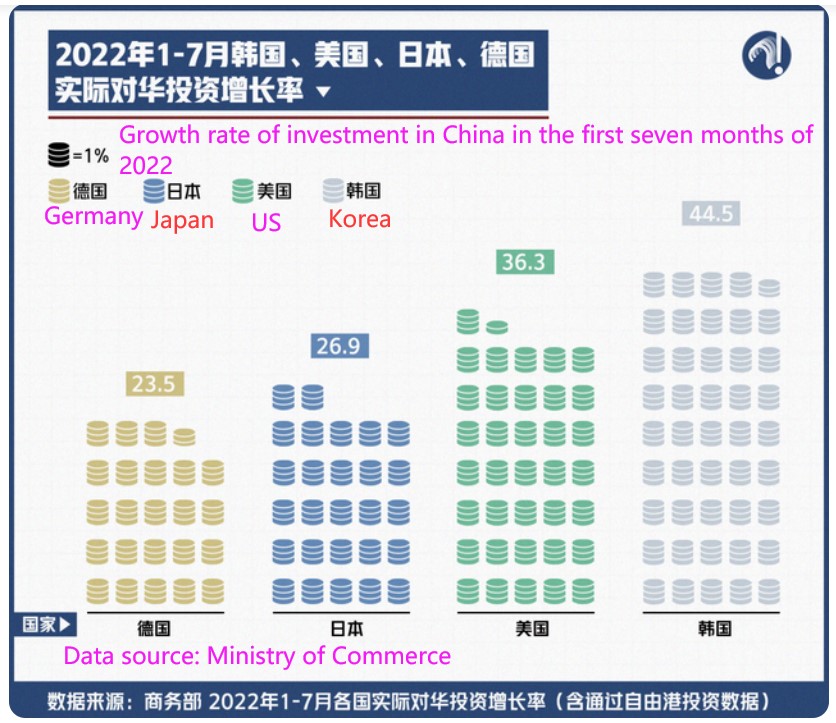

Foreign investment in China is accelerating. Recently, the Ministry of Commerce released the data of first seven months this year. The actual use of foreign capital was 798.33 billion yuan, a year-on-year increase of 17.3%.

Investing is confidence. And who has more confidence in China?

Let’s take a look at the four source countries of investment in China highlighted by the Ministry of Commerce.

The United States has increased its investment in China by 36.3%.

According to the 2022 White Paper for American Businesses in China released this year by the American Chamber of Commerce in China, more than two-thirds of member companies continue to rank China as their top market.

Seattle-based coffee chain Starbucks is aiming to open 6,000 stores in China by the end of the year.

Germany has been the pionner of foreign investment in China.

In the first half of this year, Germany’s investment in China hit a record high since 2000. There are many industries in which Germany has increased its investment in China. For example,the ‘jewel in the crown’ of its manufacturing industry – the automobile industry.

Volkswagen of Germany has been producing and operating in China for nearly 40 years. It set up the first subsidiary of its software company CARIAD in China this year. And it was lso the first overseas subsidiary of CARIAD.

Nearly 40 years ago, the presence of Volkswagen planted the seeds of growth for the Chinese auto industry.

Today, in the eyes of Volkswagen, China ranks first in the world in the new energy vehicle industry. And establishment of a new plant here represents the hope of Volkswagen.

Bringing the ‘leaders’ of the country’s top industries to China means more confidence.

From a global perspective, the United States, Japan, South Korea, and Germany are the economic leaders in the Americas, Asia-Pacific, and Europe, respectively. Their choices are very convincing.

Americans have always known this fact. China is one of the countries with the highest total returns on U.S. foreign direct investment.

According to estimates by the US Bureau of Economic Analysis, from 2000 to 2020, the average rate of return on US direct investment in China was 14.7%, much higher than the 9.7% rate of return on US direct investment abroad.

On the contrary, if US investment in China is down to half, it will cause very direct damage to the US economy. As a result, the one-time loss of gross domestic product (GDP) will be as high as $500 billion.

Even during the COVID-19 outbreak, the overall rate of return on foreign investment in China is still rising. In 2021, foreign investors will still be able to obtain a yield of over 6% when investing in China.

Want to understand more about how to succeed in China? Just contact Deep Digital China and let’s talk!