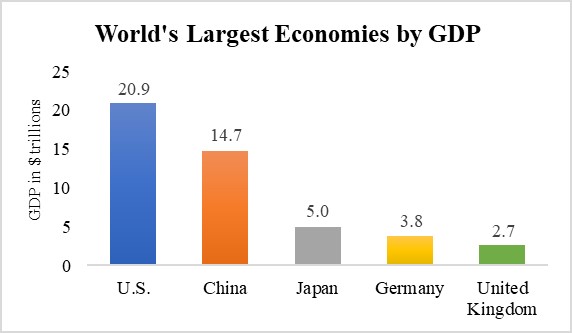

In 2020, China remained the world’s second-largest economy with a gross domestic product (GDP) of $14.7 trillion, following the United States with a $20.9 trillion GDP, and ahead of Japan with a $5 trillion GDP.

Source: World Bank

China’s economy is larger than those of the next four economies – Japan, Germany, the United Kingdom, and India – combined. China’s largest province, Guangdong, has a nominal GDP larger than Canada’s; the Yangtze river delta, centered around Shanghai, has a GDP roughly the size of Germany’s.

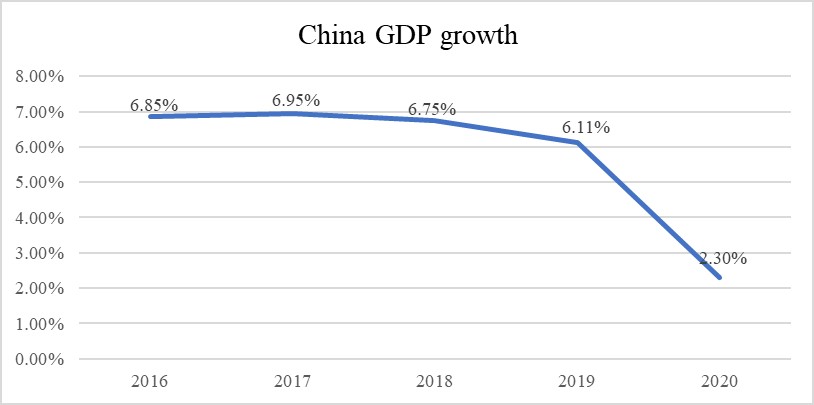

China bucked global trends and posted positive global growth in 2020, albeit at a rate well below recent years at 2.3 percent. Irrespective of the COVID-19 crisis, China’s growth rate has slowed in recent years. The country is facing a shrinking workforce, reforms that reduce debt-fueled growth, mounting provincial debt, and trade turmoil with the United States.

Source: World Bank

Although a challenging marketplace, China’s vast size, growing wealth, changing demographics, and economic transformation continues to create opportunities for well-prepared U.S. firms. China’s gross domestic product (GDP), and its market is larger than that of Japan, Germany, the United Kingdom, and India – combined.

China’s middle class has experienced one of the fastest growth rates in the world. The shift from the traditional low-wage, labor-intensive manufacturing economy towards more technology-intensive high value-added production has fostered a burgeoning middle class in China that has generated consumer demand for a broad range of products. Indeed, Chinese consumers play an increasingly significant global role, now the world’s largest market for many products from vehicles to air conditioners to video games. As a result of this growth, retail sales in China are expected to outpace those in the United States within the next couple of years.

Companies should consider their resources and long-term business strategy before entering the Chinese market. Some steps overseas companies can take in implementing a market-entry strategy include:

Consider a Regional Approach

Given the enormous size of the Chinese marketplace, companies should consider breaking down markets in China into several geographic segments and search for business partners, agents, or distributors to cover specific geographies.

China’s first-tier cities of Beijing, Shanghai, and Guangzhou are often the best locations to start when seeking new business opportunities because those cities contain the most experienced business people who deal with foreign companies. For more experienced exporters, China’s second and third-tier cities may hold pent-up market demand for American products and services.

A strategy that focuses on a niche or a specific region can often be the best initial approach for smaller companies.

China’s consumer market is divided by geography, income levels, and age. Given the size of the country, even niche markets can be highly profitable.

1, Evaluate Partners Carefully

A Chinese agent, distributor, or partner who can provide essential local knowledge and contacts is often critical for success; however, finding the right partner requires preparation, patience, and hard work.

2, Understand Local Regulations

Government officials play an essential role in the Chinese economy. Firms should actively seek to understand how their product or service is regulated and by which agencies.

3, Protect Your Intellectual Property Rights

Firms and companies should take steps to protect their intellectual property rights (IPR) under Chinese law before entering the Chinese market. Understand what IPR resources are available. Consult with specialized lawyers. Conduct thorough due diligence on potential partners or buyers before entering into any transaction. If you are interested in entering Chinese market, please feel free to contact DDC for support!